AvaTrade Singapore Review

AvaTrade Review in Singapore

AvaTrade provides a comprehensive trading platform for traders of all levels as an online broker. It has grown to become one of the world’s leading online brokers since its foundation in 2006, with offices in Dublin, London, Tokyo, Sydney, Milan, and New York. The Central Bank of Ireland, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) regulate AvaTrade. The broker also holds a license from the Japanese Financial Services Agency (FSA). This AvaTrade Singapore review will examine the broker’s features and services, as well as the fees and commissions associated with trading.

AvaTrade Singapore offers a wide range of services to traders in Singapore as a leading online trading platform. The Monetary Authority of Singapore (MAS) licenses this regulated broker. Traders can access the global markets in a secure and reliable trading environment provided by AvaTrade Singapore. Additionally, a wide range of trading instruments, including forex, CFDs, stocks, indices, commodities, and cryptocurrencies, are available. AvaTrade Singapore supports traders with educational resources and tools to become more successful.

How to Get Started with AvaTrade Singapore

Getting started with AvaTrade Singapore is easy and straightforward. Here are the steps to follow:

- Create an Account: To create an account with AvaTrade Singapore, visit their website and click on the “Sign Up” button. The website will prompt you to provide some personal information, including your name, email address, and phone number.

- Fund Your Account: To start trading, you need to fund your account once it is created. AvaTrade Singapore provides several payment methods, such as credit cards, bank transfers, and e-wallets.

- Download the Trading Platform: The AvaTrade Singapore website provides a variety of trading platforms, such as the well-known MetaTrader 4 and MetaTrader 5. You can download your preferred platform from the website.

- Start Trading: You can start trading once you download the trading platform. AvaTrade Singapore provides a variety of trading tools and resources to assist you in making informed trading choices.

AvaTrade Singapore Account Types

AvaTrade Singapore provides a variety of account kinds to meet the demands of various traders. The following accounts are available:

- Standard Account: This is the most basic account type and is appropriate for new traders. It provides competitive spreads as well as leverage of up to 1:400.

- Professional Account: This account is intended for experienced traders who require greater leverage and tighter spreads. It offers up to 1:400 leverage and spreads as low as 0.1 pips.

- AvaTrade Islamic Account: Developed for Islamic traders who demand a Sharia-compliant trading environment. It has the same benefits as the Standard and Professional accounts, but there are no interest costs.

- AvaTrade Demo Account: For traders who want to practice their trading techniques without risking real money, it provides a virtual trading environment with real-time market data and a virtual balance of $10,000.

- Managed Account: Designed for traders who desire a professional trader to manage their funds. This sort of account provides a variety of services, such as portfolio management, risk management, and market analysis.

AvaTrade Singapore provides a safe and dependable trading environment, as well as competitive spreads and leverages for all account kinds.

Trading Instruments and Markets

AvaTrade Singapore offers a wide range of trading instruments and markets for its clients. These include the following:

- Forex trading – Traders prefer the most popular instrument offered by AvaTrade Singapore, which includes more than 50 currency pairs such as major, minor, and exotic pairs. They can take advantage of tight spreads, fast execution, and leverage of up to 400:1.

- CFDs – AvaTrade Singapore offers CFDs on a wide range of markets, including stocks, indices, commodities, cryptocurrencies, ETFs, and bonds, making it another popular instrument. Traders can take advantage of the leverage of up to 400:1 and tight spreads.

- Stocks – AvaTrade Singapore offers stocks from major exchanges around the world, including the US, UK, Germany, France, Japan, and Australia. Traders can take advantage of leverage of up to 20:1 and tight spreads.

- Indices – The broker offers indices from major exchanges around the world, including the US, UK, Germany, France, Japan, and Australia. Traders can take advantage of leverage of up to 200:1 and tight spreads.

- Commodities – Offers commodities such as gold, silver, oil, and natural gas. Traders can take advantage of leverage of up to 200:1 and tight spreads.

- Cryptocurrencies – are also available for trading. AvaTrade Singapore offers cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple. Traders can take advantage of the leverage of up to 2:1 and tight spreads.

- ETFs – AvaTrade Singapore offers ETFs from major exchanges around the world, including the US, UK, Germany, France, Japan, and Australia. Traders can take advantage of leverage of up to 20:1 and tight spreads.

- Bonds – The broker offers bonds from major exchanges around the world, including the US, UK, Germany, France, Japan, and Australia. Traders can take advantage of leverage of up to 20:1 and tight spreads.

Trading Platforms and Features

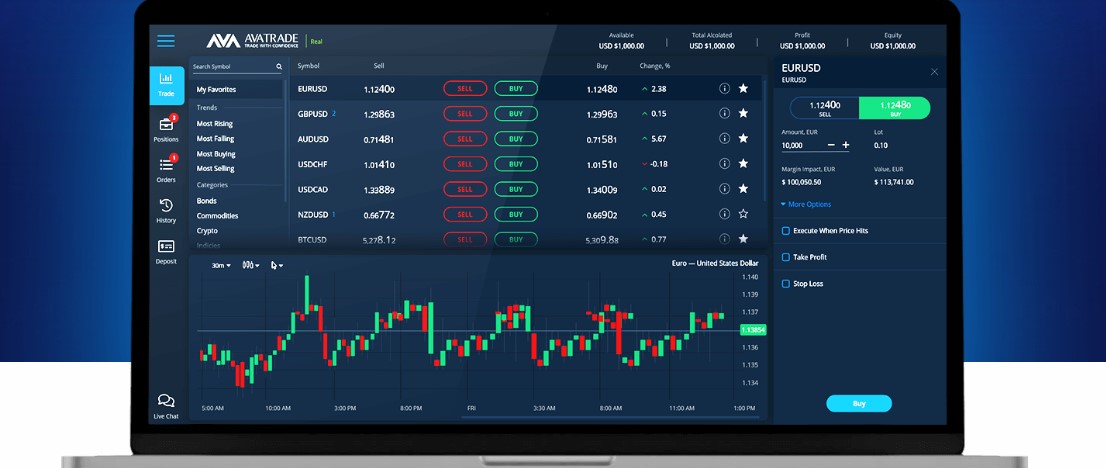

AvaTrade Singapore provides traders with a wide range of trading tools and features that enable them to trade with ease and confidence. There are several trading platforms available on AvaTrade that cater to the different needs of traders.

- WebTrader is a user-friendly trading platform that allows traders to access financial markets from anywhere in the world. The platform is web-based, which means that traders can access it from any device with an Internet connection. WebTrader is designed to be intuitive and easy to use, making it ideal for beginners.

- AvaOptions is a cutting-edge trading platform that enables traders to trade options on a wide range of financial instruments, including currencies, commodities, and stocks. The platform is designed to be user-friendly and offers a range of advanced tools and features that enable traders to make informed trading decisions.

- AvaTradeGo is a mobile trading platform that is designed for traders who want to access financial markets on the go. The platform is available on both iOS and Android devices and offers a range of advanced features, including real-time quotes, price alerts, and trading signals.

- MetaTrader 4 & 5 are popular trading platforms that traders around the world widely use. These platforms offer a range of advanced tools and features, including real-time charts, technical analysis tools, and automated trading.

- Automated Trading is another popular feature offered by AvaTrade. The platform offers several automated trading solutions, including AvaSocial, DupliTrade, and Capitalise.ai. These solutions enable traders to automate their trading strategies and take advantage of market opportunities without having to monitor the markets 24/7.

AvaTrade Deposit Options Available in Singapore

AvaTrade is a well-established trading platform that offers a wide range of deposit options for its users in Singapore. Here are the deposit options available:

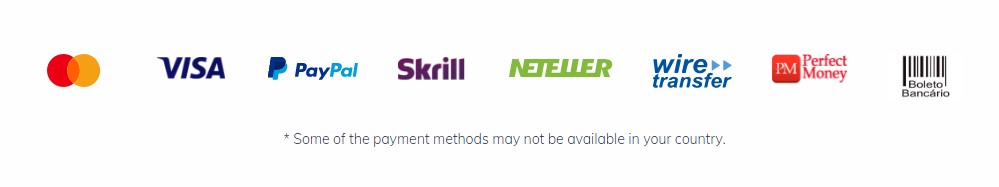

- Credit/Debit Cards: AvaTrade accepts both MasterCard and Visa. This is one of the most convenient methods of depositing funds, as transactions are processed almost instantly.

- Bank Wire Transfers: This method of deposit is secure and straightforward. However, it may take a few business days for the funds to reflect in your trading account.

- E-Wallets: AvaTrade also accepts deposits through popular e-wallets such as PayPal, Skrill, and Neteller. These digital methods of payment are fast, secure, and convenient.

- Cryptocurrencies: With the growing popularity of digital currencies, AvaTrade has also incorporated cryptocurrency as a mode of deposit. You can deposit funds using Bitcoin, which is a faster and cheaper way to transfer money.

- WebMoney: This is another digital payment service that is accepted by AvaTrade. It is popular for its ease of use and quick transaction processing times.

- Moneybookers: This is an e-commerce business that allows payments and money transfers to be made online. AvaTrade accepts Moneybookers for deposits.

Before making a deposit, be sure to check the AvaTrade minimum deposit requirements and transaction processing times. It’s also important to note that AvaTrade doesn’t charge any deposit fees. However, your bank or e-wallet service may charge a small transaction fee.

AvaTrade Withdrawal Options

AvaTrade broker offers several withdrawal options for its customers in Singapore. This allows customers to easily access their funds using the method that is most convenient for them.

- Credit/Debit Cards: AvaTrade allows users to withdraw funds directly to their credit or debit cards. However, it is important to note that you can only withdraw up to the amount you originally deposited from the same card.

- Wire Transfer: This is another popular option for withdrawing funds from AvaTrade. However, it may take up to 7 business days for the funds to reflect in your account.

- E-Wallets: AvaTrade also supports withdrawals to various e-wallets like PayPal, Neteller, and Skrill. These are usually processed within 24 hours.

Regarding the AvaTrade minimum withdrawal amount, the broker sets a minimum withdrawal at $100 for credit/debit cards and e-wallets. For wire transfers, the minimum withdrawal amount is set at $500.

It’s crucial to note that AvaTrade may charge a withdrawal fee depending on the chosen withdrawal method. Therefore, it’s recommended to check their fee structure or contact their customer support for detailed information.

Lastly, in accordance with anti-money laundering regulations, funds can only be withdrawn to a bank account or card registered in the investor’s name.

Fees & Commission

AvaTrade Singapore offers a range of financial instruments such as forex, commodities, stocks, indices, and cryptocurrencies on its popular online trading platform. Its services come with fees and commissions, like any other trading platform. AvaTrade Singapore charges fees and commissions, and here is an overview of them.

- Spreads: The bid and ask price of a financial instrument determine the spread. AvaTrade adjusts the spread according to market conditions, resulting in variable spreads. Different financial instruments have varying spreads. For instance, the spread for gold can be as low as 0.3 pips, while the EUR/USD currency pair may have a spread of 1.3 pips.

- Overnight fees: If you hold a position overnight, AvaTrade may charge an overnight fee or swap fee. This fee is a small percentage of the position’s value and is calculated based on the interest rate differential between the two currencies in a currency pair. The overnight fee may be positive or negative, depending on the direction of your trade.

- Inactivity fee: If you do not use your AvaTrade account for a certain period, the platform may charge an inactivity fee. The fee varies depending on the account type and the duration of inactivity.

- Deposit and withdrawal fees: AvaTrade does not charge any deposit or withdrawal fees. However, you may be charged by your bank or payment provider for transferring funds to or from your AvaTrade account.

- Commission: AvaTrade charges a commission for some financial instruments such as stocks and ETFs. The commission varies from 0.1% to 0.2% of the trade value, depending on the account type and the instrument traded.

AvaTrade Singapore competes well with other online trading platforms in terms of its fees and commissions. However, traders should be aware that trading fees can accumulate over time, and it is crucial to comprehend the expenses involved before executing any trades.

Education & Customer Support

AvaTrade Singapore commits to providing its customers with the best possible trading experience by offering a comprehensive range of educational and customer support services. It ensures that customers have the knowledge and resources they need to succeed through its range of online courses, webinars, and tutorials covering a variety of topics, from the basics of trading to more advanced strategies. It designs its courses to help traders of all levels gain the skills and knowledge they need to become successful.

The broker offers 24/7 customer support services that include live chat, email, and telephone support. Its knowledgeable and experienced customer service representatives are always ready to assist customers with any questions or concerns. AvaTrade Singapore dedicates itself to providing the best possible trading experience for its customers. It is confident that its comprehensive educational and customer support services will provide its customers with the resources they need to succeed.

AvaTrade Singapore Pros and Cons

Pros

- Offers a wide range of trading instruments, including forex, commodities, indices, stocks, ETFs, and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of different market conditions.

- Provides a secure and reliable trading environment, with advanced security measures in place to protect traders’ funds.

- Offers competitive spreads and low commissions, making it an attractive option for traders looking to maximize their profits.

- Provides a range of educational resources, including webinars, tutorials, and e-books, to help traders improve their trading skills.

- Offers a variety of trading platforms, including the popular MetaTrader 4 and 5, as well as its own proprietary platform.

Cons

- Does not offer a wide range of customer support options, which may be a disadvantage for traders who need assistance with their trading.

- Does not offer a wide range of payment methods, which may be a disadvantage for traders who prefer to use alternative payment methods.

- Does not offer a wide range of bonuses and promotions, which may be a disadvantage for traders who are looking to maximize their profits.

Is AvaTrade Legal in Singapore?

AvaTrade is legal in Singapore. It is an internationally recognized trading platform and is permitted to operate in various countries, including Singapore. Though it is not directly regulated by the Monetary Authority of Singapore (MAS), AvaTrade is regulated by various top-tier financial authorities globally, such as the Central Bank of Ireland. This regulation provides users with a level of security and trust, assuring them that the platform operates within legal and ethical guidelines. Singaporean users can confidently engage in trading activities with AvaTrade, enjoying the platform’s extensive features and benefits.

AvaTrade Review Singapore – Conclusion

Traders looking for a reliable and secure online trading platform can choose AvaTrade Singapore. AvaTrade Singapore offers a wide range of features and tools to help traders make informed decisions and maximize their profits. Additionally, the customer service team is very helpful and responsive. In summary, AvaTrade Singapore is a great choice for traders seeking a reliable and secure online trading platform.

Check out our reviews of other recommended forex brokers in Singapore.

easyMarkets Singapore | Exness Singapore Review | FBS in Singapore Review | LiteFinance Singapore Review | XM Forex Review | FxPro Broker Review | Eightcap Review